RISK AND MONEY MANAGEMENT

Developments and changes to capital represent a continuous challenge when it comes to carrying out the right action at a particular point in time and the reaction that ensues. This causal effect is also a contradiction in itself. In summary, this can be reduced to a common denominator: the better the risk and money management system used for each strategy is, the stronger the capital growth will be, and the smaller the loss of capital with a faster recovery after a drawdown.

RISK MANAGEMENT

Taken in isolation, the ultimate goal of risk management is to preserve capital. Risks range in nature from market risk and liquidity risk to interest rate risk and operational risk, which includes technical failures. The presence of such risks can never be ruled out completely, but they are factored into calculations in forex management.

In fact, risk management represents the foundation of sustainable success in currency trading. Only those in a position to control risk in an optimal way can survive in markets in the long run. Even with the support of the most sophisticated software, risk assessment ultimately boils down to the experience of currency traders.

Only a highly qualified foreign-currency trader with extensive experience understands that no firm conclusions can be drawn about the future of a bifurcated system such as forex trading. Such professionals can achieve the necessary result like nobody else, accepting losses with equanimity and understanding that they are a necessary part of the overall process.

MONEY MANAGEMENT

In money management, the primary goal is performance. In this sense, money management activities (determining the size of positions) are derived from the risk management strategy and include decisions regarding the amount of capital to use for each position.

The decision-making process cannot occur in isolation, but must be in harmony with system performance figures, risk preference, the available risk capital and technical resources. We define position management as the division of a position into several parts, for example with a pyramid structure or partially liquidating a position to cash in on profits.

When managing the positions of a portfolio with several strategies, money management entails a variety of decision fields. This results in a maximum possible number of contracts for each trading transaction:

- Market selection

- Ranking Opportunities

- Exposure control: capital to expose, total level of investment

- Maximum risk per trade

- Choice of leverage (how large should the leverage of the instrument be?)

- Distribution of the capital over different strategies

OVERALL EXPOSURE, LEVEL OF INVESTMENT

Exposure control is an important aspect of risk and money management. It determines how much of the total capital is exposed as risk capital on the markets. If various strategies are used in portfolio trading, there is automatically a problem of total exposure. In principle, the higher the profit targets are set, the higher the level of investment must be. The overall exposure can be a fixed amount of the total capital or weighted as a variable share of the portfolio.

The level of investment must also depend on correlations between the various markets or portfolio strategies. For example, if a trend trading system is used, the exposure can be higher if low-correlated markets are involved. The higher the correlation of commodities in the portfolio, the lower the overall exposure should be in order to minimise risk. Naturally, this is also true for the correlation between different systems in the portfolio.

DIVERSIFICATION

Alongside exposure control, diversification provides a further tool for risk management. The distribution of risk across different markets or across multiple systems in a portfolio is based on the assumption that a currency dealer has only a limited view of the future and can never know exactly what profits can be expected. The logic behind the idea of diversification works on the premise that market participants optimise the return for a given level of risk.

To control the effects of diversification, the correlation of commodities in the portfolio must be known, as must the correlation of systems if multiple strategies are traded simultaneously. Although it is possible to determine the historic correlation of two specified elements at any time, no calculations for the future can be made. Even correlations that have lasted for decades between two commodities can suddenly change direction to the detriment of the portfolio.

Diversification also has a psychological effect. If several systems are used in combination at the same time, then a temporary loss series in a single system will not harm the portfolio to such a great extent.

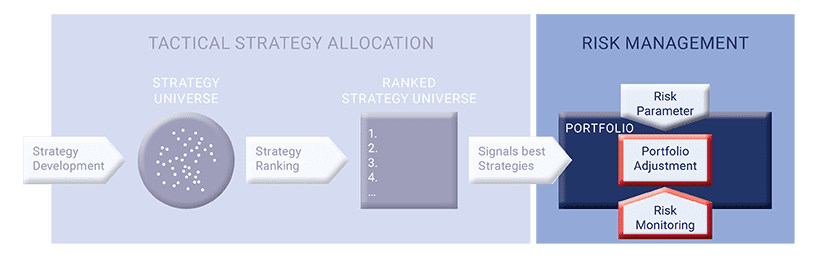

SECOND PROCESS OF THE INVESTMENT: RISK MANAGEMENT

Tactical Strategy Allocation is followed by risk management. This part of the process has three main components: risk parameters, risk monitoring and portfolio adjustment.

RISK PARAMETERS

- The total portfolio risk is defined a priori using global risk parameters

- The aggregate value at risk for the trading strategies, which is calculated on a daily basis, serves to determine the maximum risk

- Maximum leverage and maximum exposure are also defined

PORTFOLIO ADJUSTMENT AND RISK MONITORING

- The target risk, which is derived from the global risk parameters, is compared with the portfolio's actual risk

- Risk monitoring is tick-based

- If the actual risk varies from the target risk the portfolio is adjusted instantly

- These parameters make it possible to generate a high risk-adjusted performance.

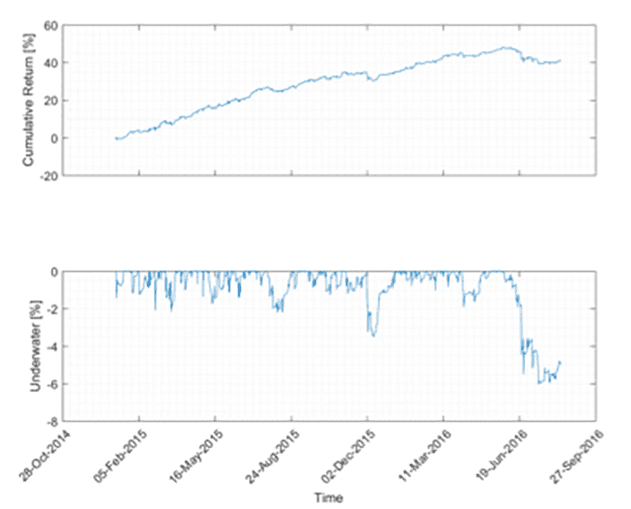

EXAMPLE: TESTED PORTFOLIO

Applying the Tactical Strategy Allocation and our risk management process creates the basis for an optimal risk-adjusted performance.

The lower chart shows the test of a conservative portfolio, which stands out for its moderate return, with few draw-down phases of short duration.